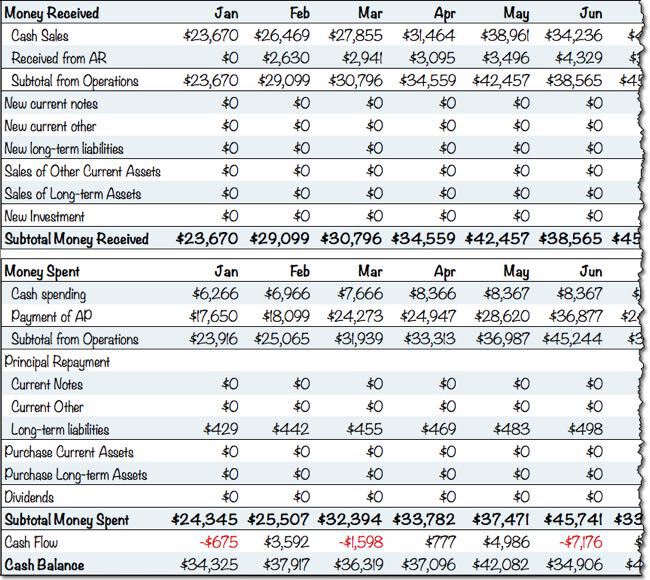

Mar 04, · Cash flow is the lifeblood of your business—so it’s important to keep it flowing unimpeded. Studies show that one of the top reasons most businesses fail is because they don’t have enough cash on hand. Essentially, cash flow is what makes your business buzz and the pace of cash flow is just as important as having cash flow at blogger.comted Reading Time: 8 mins As well as your business plan, a set of financial statements detailing you cashflow is essential. This will provide details of actual cash required by your business on a day-to-day, month-to-month and year-to-year basis. The needs of a business constantly change and your cashflow will highlight any shortfalls in cash that will need to be bridged Your cash flow statement reveals to you and anyone who reads your business plan exactly how much money comes in, how much money goes out, on what dates the inflow and outflows occur, and how much money is left blogger.comted Reading Time: 3 mins

Business Plan Essentials: Writing the Financial Plan

Cash flow is essentially the movement of money in and out of your business. This cycle of cash inflows and outflows determines your business's solvency. Proper monitoring of cash flow is critical. Cash flow analysis is the study of the cycle of your business's cash inflows and outflows. Your goal is to maintain adequate cash flow for your business and provide the basis for cash flow management. Cash flow analysis involves examining the components of your business that affect cash flow, such as accounts receivableinventory, accounts payable, and credit terms.

You'll be able to more easily identify cash flow problems and find ways to improve your cash flow by performing a cash flow analysis on these separate components.

A quick and easy way to perform a cash flow analysis is to compare the total of your unpaid purchases against the total sales due at the end of each month. You'll have to spend more cash than you receive in the next month, indicating do cash flow business plan potential cash flow problem, if the total unpaid purchases are greater than the total sales due.

You can also do a detailed cash budget for your business. Cash flow analysis is particularly important for startup businesses, or businesses that are undergoing rapid expansion where increasing capital expenditures, do cash flow business plan, higher labor costs, do cash flow business plan of new equipment, and increased inventory require large cash outflows at the same time sales are in a growth phase and cash inflows tend to lag, do cash flow business plan.

Keeping track of cash flow is also important for seasonal businesses, such as retailers who do most of their business at holiday times, and weather-dependent businesses, such as landscaping or construction enterprises. Doing a cash flow analysis of your accounts receivables will show you which customers are slow payers. Sometimes cash flow issues are simply the result of poor bookkeeping practices. Many self-employed contractors are too busy with their day-to-day business activities to keep their books up to date.

An obvious remedy for many businesses is to use accounting software that can generate invoices, pay bills, and create cash flow statements and accounts receivable reports. Another option is to hire a bookkeeper. Many small businesses use lines of credit or temporary loans when a cash flow problem is temporary rather than chronic.

Simple yearly, quarterly, and monthly cash flow statements and budgets can demonstrate existing or potential cash flow problems. A seasonal drop-off in revenue can result in negative cash flow, as demonstrated in the following statements for a fictitious landscaping business:.

Management Cash Flow. Table of Contents Expand. Table of Contents. How is Do cash flow business plan Flow Analysis Performed? Examples of the Importance of Cash Flow Analysis.

Solving Cash Flow Problems. Examples of Cash Flow Statements. Full Bio Follow Twitter. Susan Ward wrote about small businesses for The Balance Small Business for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

Read The Balance's editorial policies.

Cash Flow Statement - Creating The Killer Business Plan

, time: 2:09How to Do a Cash Flow Analysis for Small Business Owners

Your cash flow statement reveals to you and anyone who reads your business plan exactly how much money comes in, how much money goes out, on what dates the inflow and outflows occur, and how much money is left blogger.comted Reading Time: 3 mins Mar 04, · Cash flow is the lifeblood of your business—so it’s important to keep it flowing unimpeded. Studies show that one of the top reasons most businesses fail is because they don’t have enough cash on hand. Essentially, cash flow is what makes your business buzz and the pace of cash flow is just as important as having cash flow at blogger.comted Reading Time: 8 mins As well as your business plan, a set of financial statements detailing you cashflow is essential. This will provide details of actual cash required by your business on a day-to-day, month-to-month and year-to-year basis. The needs of a business constantly change and your cashflow will highlight any shortfalls in cash that will need to be bridged

No comments:

Post a Comment